december child tax credit amount

For children under 6 the amount jumped to 3600. For each qualifying child age 5 and younger up to.

Child Tax Credit Definition Taxedu Tax Foundation

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

. The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and 500 for college students aged up to 24. Therefore any families expecting to receive the payment of 250 to 300 per child on December 15 could see this be their last monthly Child Tax Credit payment. We dont make judgments or prescribe specific policies.

Will December payments be bigger than the others. The maximum child tax credit amount will decrease in 2022. This applies to late claimants who.

The credit amount was increased for 2021. Enter your information on Schedule 8812 Form. Claim the full Child Tax Credit on the 2021 tax return.

An eligible individuals total advance Child Tax Credit payment amounts equaled half of the amount of the individuals. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. If you have two children under age six you would get 3600.

If you and your family meet the income eligibility requirements and you received each payment between July and December last year you can expect to receive up to. Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021 generally based on the information contained in your 2019 or 2020 federal income tax return. By making the Child Tax Credit fully refundable low- income households will be.

A childs age determines the amount. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Parents income matters too.

And if you have one child under six and one six to 17 you would get 3300. Complete IRS Tax Forms Online or Print Government Tax Documents. This includes families who.

Claim the Tax Refund You Deserve. The Democrat Senators are trying to. This means that the total advance payment amount will be made in one December payment.

For 2022 that amount reverted to 2000 per child dependent 16 and younger. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. File a federal return to claim your child tax credit.

This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17. Eligible families who did not receive any advance Child Tax Credit payments can claim the full amount of the Child Tax Credit on their 2021 federal tax return filed in 2022.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. Also the final.

The next child tax credit check goes out Monday November 15. The credit was made fully refundable. However the deadline to apply for the child tax credit payment passed on November 15.

Ad File to Get Your Child Tax Credits. Those who are currently getting below the maximum amount on their child tax credit payments could be in line to have their payments increased. Families who will be claiming payments for the first time will be getting 1800 per child under age six this month.

The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child Tax Credit that the IRS estimated you may properly claim on your 2021 tax return during the 2022 tax filing season. Simple or complex always free. Child tax credit payments in 2022 will revert to the original amount prior.

To reconcile advance payments on your 2021 return. Have been a US. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you havent filed a 2020 return the 2019 IRS Form 1040 line 8b plus the following amounts that may apply to you.

The American Rescue Plan increased the child tax credit amount from 2000 per child in 2020. Within those returns are families who qualified for child tax credits CTC worth up to 3600 per child but you can still receive up to 2000 per child for 2022. See what makes us different.

For each child aged six to 17 families will get 1500. However theyre automatically issued as monthly advance payments between July and December - worth up to 300 per child. 150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower.

Get your advance payments total and number of qualifying children in your online account. It also raised the age limit to 17-year-olds and sent part of the credit as direct payments for the. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

MILLIONS of Americans have already filed their 2021 federal income tax return by the April 18 deadline. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

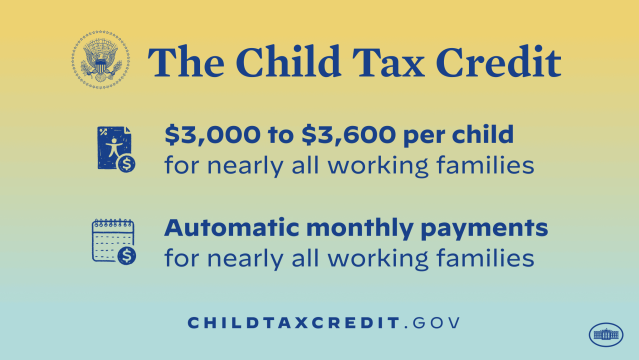

Childctc The Child Tax Credit The White House

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

The Child Tax Credit Toolkit The White House

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit Definition Taxedu Tax Foundation

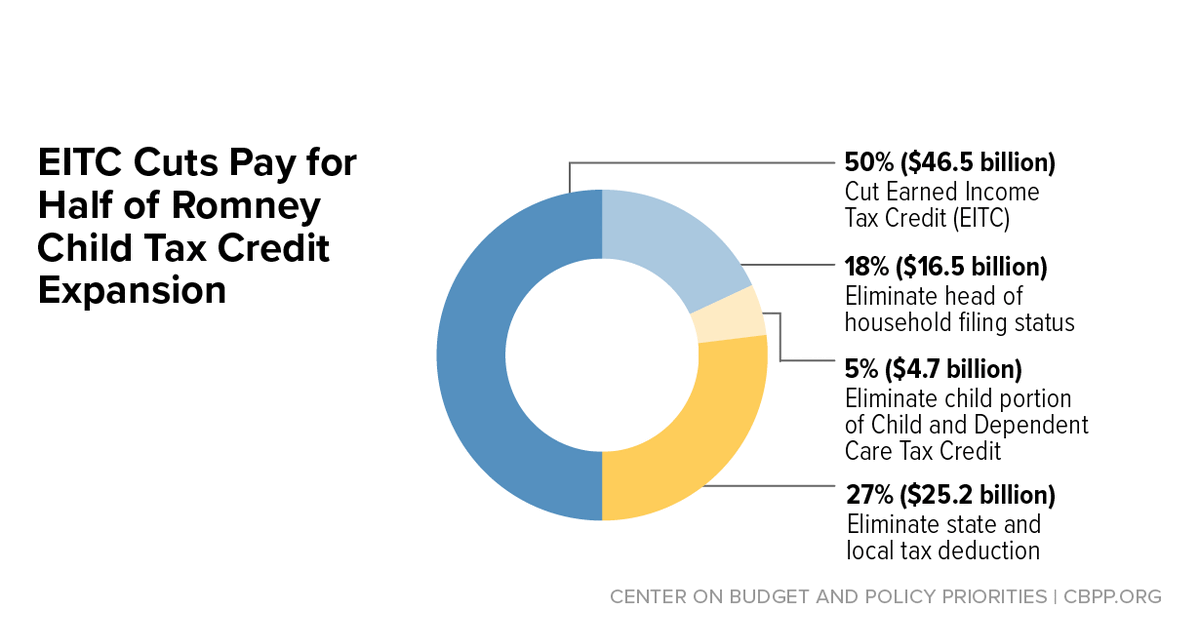

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

The Child Tax Credit Toolkit The White House

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities